Donate Today

Help End Hunger Today in Our Community

Every $10 you donate provides enough food for up to 4 meals for our neighbors facing hunger. Thank you for your support.

$25

provides a full cart of groceries for one family

$50

provides 3 lbs of meat for 70 families

$100

provides produce for 130 families

$250

provides eggs for 90 families

Unless we act today, thousands of our neighbors in Fort Worth will go to bed tonight not knowing where their next meal will come from. Every hour they spend worrying about food is an hour they can’t dedicate to building their path out of poverty.

4Saints & Friends Episcopal Food Pantry is a 501(c)(3) tax-exempt, charitable organization.

Other Ways to Give

During Your Lifetime

Tributes

A tribute donation offers you a thoughtful way to remember, honor, or celebrate a special person or occasion while contributing to our mission to feed families.

If you want to support 4Saints & Friends with a tax-smart donation this year, a gift of appreciated stocks, bonds, or other marketable securities you have held for over one year is the right choice.

Legacy Giving: After Your Lifetime

When writing your will, please include 4Saints & Friends; your legacy will continue after your lifetime. Charitable gifts can only be made from your estate with a stated designation through a will.

Some people prefer the increased flexibility that a beneficiary designation provides by using IRAs and retirement plans, life insurance policies, or commercial annuities.

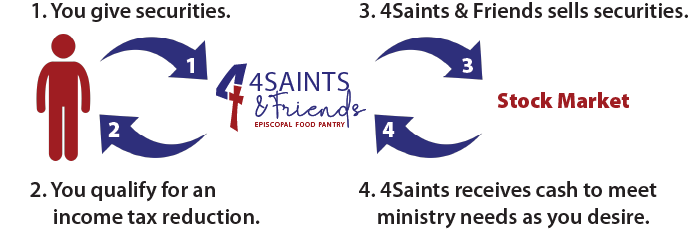

An Outright Gift of Securities

Save in Taxes This Year

HOW IT WORKS

When making a gift of appreciated securities owned for more than one year, you will receive a double tax benefit:

- You qualify for a federal income tax charitable deduction based on the current fair market value of the securities, regardless of their original cost.

- You can reduce or eliminate capital gains taxes on any increase in the value of the securities, taxes you would pay if you had otherwise sold them.

Steps to Make Your Gift

If you have the physical securities, either hand-deliver them or mail us the stocks and stock power separately. Our mailing address is P.O. Box 8695, Fort Worth TX, 76124.

Please contact us at or (817) 609-4122 if you're considering blessing us with a gift of appreciated securities.

Will and Living Trust

When writing your will, please include 4Saints & Friends; your legacy will continue after your lifetime. Charitable gifts can only be made from your estate with a stated designation through a will. To do so, please use the following bequest language:

“I, [name], give, devise and bequeath 4Saints & Friends the sum of [$ ______ or ____ % of my estate].”

Life Insurance, Retirement Plans

Only some people want to commit to making a gift in their wills or estates. Some prefer the increased flexibility that a beneficiary designation provides by using:

- IRAs and retirement plans

- Life insurance policies

- Commercial annuities

It only takes three simple steps to make this type of gift. Here's how to name 4Saints & Friends as a beneficiary:

- Contact your retirement plan administrator, insurance company, bank, or financial institution for a change-of-beneficiary form.

- Decide what percentage (1 to 100) you would like us to receive and name us, along with the percentage you chose, on the beneficiary form.

- Return the completed form to your plan administrator, insurance company, bank, or financial institution.

4Saints & Friends cannot provide direct legal or financial advice related to planned giving and advises all individuals to seek independent counsel from qualified estate planning attorneys and wealth managers before deciding on a planned gift.